Bitcoin, the world’s first decentralized digital currency, has revolutionized the financial world since its inception in 2009. Bitcoin operates on a decentralized ledger technology called blockchain and has experienced a dramatic evolution since its creation. In this blog, we will explore the history of bitcoin, its evolution, and its impact on the financial industry.

The Origins of Bitcoin

Bitcoin was created in 2009 by an unknown individual or group using the pseudonym “Satoshi Nakamoto.” The goal of bitcoin was to create a decentralized digital currency that was not controlled by any government or financial institution. Bitcoin’s decentralized nature makes it resistant to censorship, fraud, and government interference.

Early Adoption and Market Growth

Bitcoin saw slow adoption in its early years, with only a few enthusiasts and developers using the currency. However, in 2011, the currency gained traction when it was used on the dark web for illegal activities. This led to increased media attention and interest in the currency. As a result, the price of bitcoin surged from less than $1 in 2011 to over $1,000 in 2013.

Mainstream Acceptance

Bitcoin began to gain mainstream acceptance in 2014 when major companies like Microsoft and Overstock.com started accepting the currency as a form of payment. This increased adoption led to a surge in the price of bitcoin, which reached an all-time high of nearly $20,000 in 2017.

Regulation and Legal Issues

As bitcoin gained popularity, governments around the world began to take notice and regulate the currency. The legality of bitcoin varies from country to country, with some countries like Japan recognizing it as a legal currency, while others like China have banned it altogether. Despite the legal challenges, bitcoin has continued to grow and evolve.

Bitcoin as an Investment

Bitcoin’s dramatic rise in price has made it a popular investment option for individuals and institutions alike. The currency’s scarcity, coupled with its decentralized nature, has made it an attractive investment for those looking to diversify their portfolios.

Bitcoin and the Future of Finance

Bitcoin and other cryptocurrencies have the potential to revolutionize the financial industry by making transactions faster, cheaper, and more secure. Blockchain technology, which underpins bitcoin, is already being used in various industries, including finance, supply chain management, and healthcare.

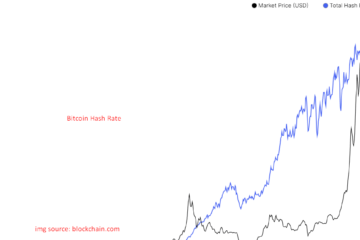

Challenges and Concerns

Despite the potential benefits of bitcoin, there are still challenges and concerns that need to be addressed. These include the scalability of the blockchain network, energy consumption, and security issues.

Conclusion

In conclusion, bitcoin has come a long way since its creation in 2009. Its decentralized nature, coupled with its potential to revolutionize the financial industry, has made it a popular investment and a topic of interest for governments and businesses around the world. As the currency continues to evolve, we can expect to see more innovative use cases and solutions emerging in the world of finance and beyond.