Cryptocurrencies have become a hot topic in recent years, with the rise of Bitcoin and other digital currencies making headlines across the globe. In this blog, we will explore what cryptocurrencies are, how they work, and how they will impact the future economy.

Introduction

Cryptocurrencies are digital or virtual currencies that use cryptography for security. They operate independently of central banks and are decentralized, meaning that they are not subject to government or financial institution control. Cryptocurrencies have become increasingly popular due to their fast transaction times, low fees, and ability to store value without the need for a physical asset.

What is Cryptocurrency?

Cryptocurrency is a digital or virtual currency that uses cryptography for security. Cryptography is the practice of secure communication in the presence of third parties. Cryptocurrencies use cryptography to ensure that transactions are secure and that they cannot be counterfeited or duplicated. Cryptocurrencies are not tied to any government or financial institution, and their value is not backed by a physical asset.

How do Cryptocurrencies Work?

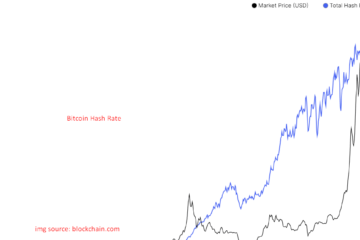

Cryptocurrencies use a distributed ledger technology called the blockchain to record transactions. A blockchain is a digital ledger that is shared among a network of computers. When a transaction occurs, it is recorded on the blockchain and verified by a network of computers. The computers on the network are rewarded with new cryptocurrency for verifying transactions.

How will Cryptocurrencies Help the Future Economy?

Cryptocurrencies have the potential to revolutionize the future economy in several ways:

1. Decentralization

Cryptocurrencies are decentralized, meaning that they are not controlled by any central authority. This could make them more resilient to economic shocks and less prone to government interference.

2. Fast Transactions

Cryptocurrencies can facilitate fast and cheap transactions across borders without the need for intermediaries such as banks or payment processors. This can help to reduce transaction costs and increase the speed of global trade.

3. Lower Fees

Traditional banking transactions are often subject to high fees, which can be a barrier to entry for small businesses and individuals. Cryptocurrencies have the potential to significantly reduce transaction fees, making it more accessible to a wider range of people.

4. Financial Inclusion

Cryptocurrencies can provide financial services to people who may not have access to traditional banking services. This could help to increase financial inclusion and reduce poverty.

Conclusion

Cryptocurrencies have the potential to revolutionize the future economy in several ways. They offer fast transaction times, low fees, and decentralization, which can make them more resilient to economic shocks and less prone to government interference. Cryptocurrencies can also provide financial services to people who may not have access to traditional banking services, helping to increase financial inclusion and reduce poverty. As cryptocurrencies continue to gain popularity, it will be interesting to see how they will impact the future economy.