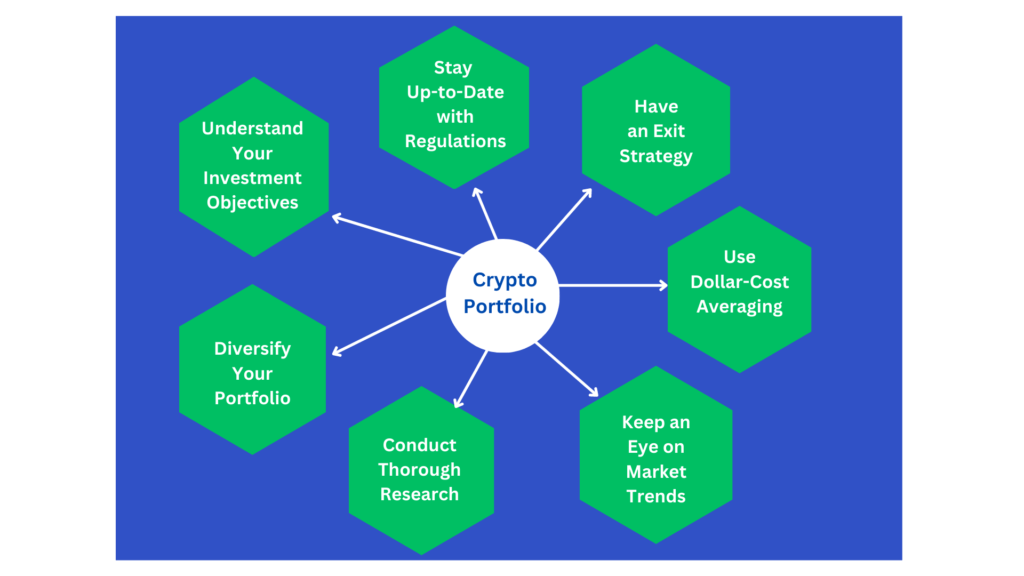

Cryptocurrency has revolutionized the world of finance and investing. With the increasing popularity of crypto assets, more and more investors are looking to add them to their investment portfolios. However, investing in crypto is not like traditional investing, and it requires a different approach. In this blog post, we will explore the best strategies to manage a crypto portfolio.

Understand Your Investment Objectives

Before you start investing in cryptocurrencies, you need to understand your investment objectives. Do you want to invest for short-term gains or long-term growth? Are you looking to diversify your portfolio or take a riskier approach? Understanding your investment objectives will help you determine the best investment strategy.

Diversify Your Portfolio

One of the most important principles of investing is diversification. It is crucial to spread your investments across different assets to minimize risk. The same principle applies to investing in crypto. You should not put all your money into a single cryptocurrency, but rather invest in multiple cryptocurrencies that have different use cases, teams, and technologies. This will help you minimize the risk of losing all your money if one cryptocurrency goes down.

Conduct Thorough Research

Investing in cryptocurrency is risky, and you need to conduct thorough research before investing. Researching different cryptocurrencies, their technologies, and their teams is crucial to understanding their potential for growth. You should also research the market trends, news, and events that could affect the value of your investments.

Keep an Eye on Market Trends

The cryptocurrency market is highly volatile, and it is essential to keep an eye on the market trends. Analyzing the market trends will help you make informed decisions about buying and selling cryptocurrencies. You can use technical analysis tools and market data to monitor market trends and make better investment decisions.

Use Dollar-Cost Averaging

Dollar-cost averaging is a strategy that involves investing a fixed amount of money in a particular asset at regular intervals. This strategy can help you reduce the risk of investing all your money in a single asset at the wrong time. By investing a fixed amount of money at regular intervals, you can take advantage of market fluctuations and get a better average price over time.

Have an Exit Strategy

Investing in crypto is risky, and you need to have an exit strategy in place. An exit strategy is a plan for selling your investments when the market conditions change. You should have a clear plan for when to sell your investments, and you should stick to it. This will help you avoid making emotional decisions that could lead to losses.

Stay Up-to-Date with Regulations

Cryptocurrencies are subject to different regulations in different countries. You need to stay up-to-date with the regulations in your country to avoid legal problems. You should also be aware of any tax implications of investing in crypto and consult with a tax professional to ensure that you are following the law.

In conclusion, investing in crypto requires a different approach than traditional investing. Diversifying your portfolio, conducting thorough research, keeping an eye on market trends, using dollar-cost averaging, having an exit strategy, and staying up-to-date with regulations are some of the best strategies to manage a crypto portfolio. By following these strategies, you can minimize your risks and maximize your gains in the crypto market.