Swing trading is a popular trading strategy that involves holding a financial asset, such as a stock or a currency, for a short period, typically ranging from a few days to a few weeks, to take advantage of price swings. Swing traders attempt to profit from the up and down movements in the market, as opposed to long-term investors who typically hold assets for several months or years. In this blog, we will explore what swing trading is, how it works, and some of the key strategies used by successful swing traders.

What is Swing Trading?

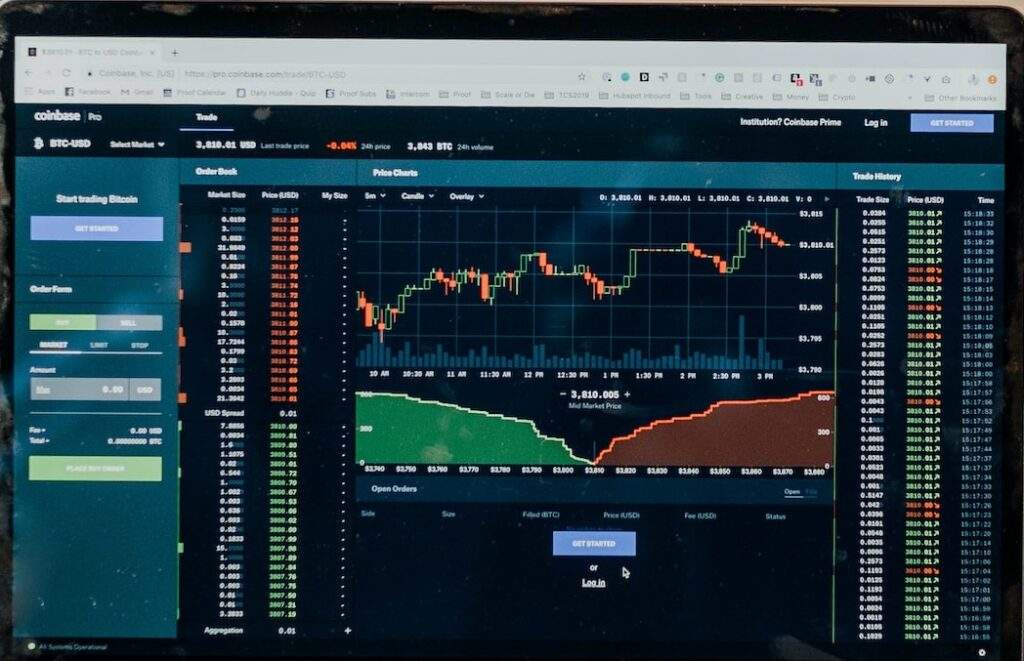

Swing trading is a short-term trading strategy that aims to capture gains from the price movements of an asset, typically over a period of a few days to a few weeks. Swing traders rely on technical analysis, which involves analyzing charts and using technical indicators, to identify trends and potential price reversals. Swing trading is different from day trading, which involves buying and selling an asset within the same day, and long-term investing, which involves holding an asset for several months or years.

How Does Swing Trading Work?

Swing trading involves analyzing charts to identify the trend of an asset and finding entry and exit points to buy and sell the asset. The goal of swing trading is to capture the price movements of an asset during a specific time period. Swing traders use technical analysis tools, such as moving averages, trend lines, and chart patterns, to identify potential trading opportunities.

Swing traders typically use a combination of fundamental and technical analysis to make trading decisions. Fundamental analysis involves analyzing a company’s financial statements and other economic factors that could impact the price of an asset. Technical analysis, on the other hand, involves analyzing charts and using technical indicators to identify potential trends and reversals in the market.

Successful swing traders typically have a solid understanding of market trends and price movements, as well as the ability to make quick decisions based on changing market conditions. Swing trading requires discipline, patience, and risk management, as swing traders must be prepared to cut their losses and take profits quickly.

Key Strategies for Swing Trading

There are several strategies that successful swing traders use to identify potential trading opportunities and manage their risk. Some of the key strategies include:

- Trend Trading: Trend trading involves identifying the trend of an asset and taking a position in the direction of the trend. Trend traders typically use technical indicators, such as moving averages, to identify the trend of an asset.

- Breakout Trading: Breakout trading involves taking a position in an asset when it breaks through a key resistance or support level. Breakout traders typically use chart patterns, such as triangles and head and shoulders, to identify potential breakout opportunities.

- Counter-Trend Trading: Counter-trend trading involves taking a position against the prevailing trend. Counter-trend traders typically use technical indicators, such as the Relative Strength Index (RSI), to identify overbought or oversold conditions in the market.

- News Trading: News trading involves taking a position in an asset based on news and economic data. News traders typically use fundamental analysis to identify potential trading opportunities.

- Position Sizing: Position sizing involves determining the size of the position based on the risk and reward of the trade. Successful swing traders typically use risk management strategies, such as stop-loss orders, to limit their losses and manage their risk.

As with any trading strategy, it is essential to have a solid understanding of the market and the asset you are trading. Swing trading requires a combination of technical and fundamental analysis, risk management, and discipline to make profitable trades. Additionally, it is important to be patient and not to let emotions guide your trading decisions.

Conclusion

Swing trading is a popular trading strategy that involves holding an asset for a short period to capture gains from price movements. Successful swing traders typically rely on technical analysis, trend analysis, and risk management to make trading decisions. Swing trading requires discipline, patience, and the ability to make quick decisions based on changing market conditions. While swing trading can be profitable, it also carries significant risks, and it is important to understand the market and manage risk carefully. With the right strategies and discipline, swing trading can be a successful trading strategy for traders looking to take advantage of short-term market movements. However, swing trading is not for everyone, and it requires a significant amount of time, effort, and discipline to be successful.