Cryptocurrency trading has gained immense popularity in recent years. The volatility of cryptocurrencies like Bitcoin, Ethereum, and others has attracted a lot of traders to enter the market. However, trading cryptocurrencies comes with a few challenges, one of which is slippage. In this blog, we’ll take a deep dive into what slippage is and how it works for cryptocurrency trading.

Introduction

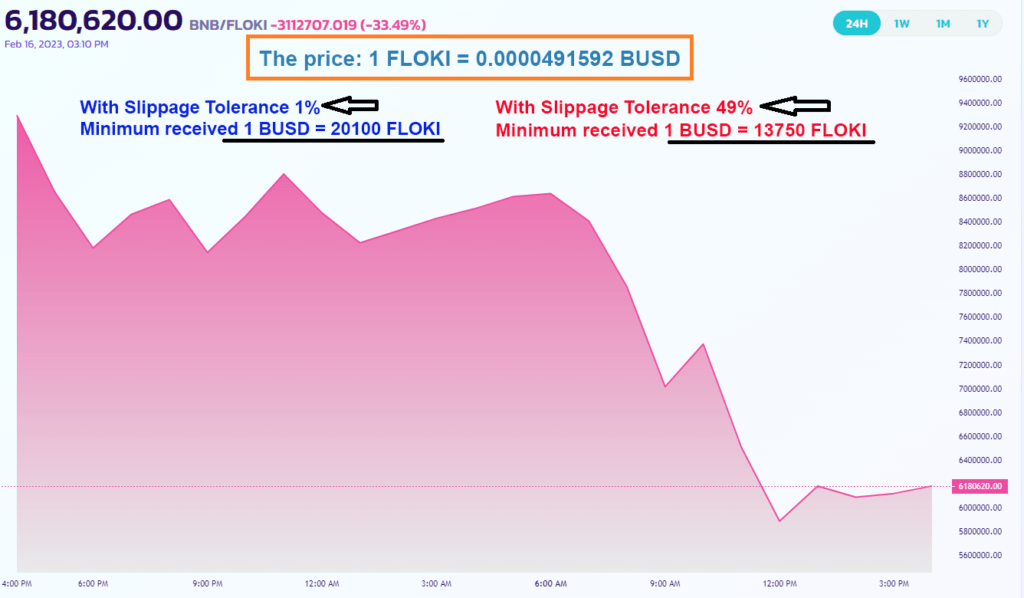

Slippage is a term used to describe the difference between the expected price of a trade and the actual executed price of that trade. Slippage is an inevitable part of trading, especially in a fast-moving market like cryptocurrencies, where prices can change rapidly within a few seconds. In simple terms, slippage occurs when the price of a cryptocurrency moves between the time you place an order and the time that order is executed. It’s important to understand how slippage works as it can have a significant impact on your trading strategy.

Causes of Slippage

Slippage can occur due to a variety of reasons, including market volatility, order size, and liquidity. Let’s take a closer look at each of these factors.

Market Volatility

The cryptocurrency market is known for its volatility, with prices fluctuating rapidly within a short period of time. If you place a limit order at a specific price, and the market moves quickly in the opposite direction, there’s a high chance of experiencing slippage. In this case, the order may not be filled at the expected price, and instead, you may end up paying a higher price for the cryptocurrency.

Order Size

The size of your order can also impact the slippage you experience. Larger orders can cause more significant price movements, resulting in increased slippage. If you place a large order to buy a cryptocurrency, the market may not have enough liquidity to fill the order at the expected price, resulting in slippage.

Liquidity

Liquidity refers to the ability to buy or sell a cryptocurrency quickly without affecting the market price significantly. Cryptocurrencies with high liquidity tend to have lower slippage as there are many buyers and sellers in the market, which makes it easier to execute orders at the expected price. On the other hand, cryptocurrencies with low liquidity can have higher slippage as it’s more challenging to find a counterparty to execute the order.

How Slippage Works in Cryptocurrency Trading

To understand how slippage works in cryptocurrency trading, let’s take an example. Suppose you want to buy 10 BTC at a limit price of $50,000. You place the order, and a few seconds later, the price of Bitcoin increases to $50,500. If there aren’t enough sellers in the market to fulfill your order, the order will be filled at the next available price, which is $50,500. In this case, you experience slippage of $500, which is the difference between your expected price and the actual price at which the order was executed.

Slippage can also occur in other scenarios, such as when you place a market order, which is executed at the best available price. In this case, the price at which the order is executed may not be the same as the current market price, resulting in slippage.

How to Mitigate Slippage

While slippage is an inevitable part of trading, there are a few strategies you can use to mitigate its impact. Here are some tips:

Use Limit Orders

Limit orders allow you to specify the maximum price you’re willing to pay to buy a cryptocurrency or the minimum price you’re willing to accept to sell it. This can help you avoid slippage, as the order will only be filled if the price meets your criteria.

Monitor Market Conditions

Monitoring market

conditions is essential when trading cryptocurrencies. By keeping an eye on the price movements and liquidity of the market, you can get an idea of how much slippage you might experience. This can help you adjust your trading strategy accordingly.

Diversify Your Portfolio

Diversification is an important risk management strategy in cryptocurrency trading. By spreading your investments across different cryptocurrencies and markets, you can reduce the impact of slippage on your overall portfolio.

Use Stop-Loss Orders

Stop-loss orders are another way to mitigate slippage. They allow you to specify a price at which you want to sell a cryptocurrency if it falls below a certain level. This can help limit your losses in case of a sudden price drop, reducing the risk of slippage.

Conclusion

Slippage is a common issue in cryptocurrency trading, but it doesn’t have to be a significant obstacle. By understanding the causes of slippage and using the right strategies to mitigate its impact, you can continue to trade cryptocurrencies effectively. Whether you’re a beginner or an experienced trader, it’s important to keep slippage in mind and be prepared for its potential impact on your trading. With the right tools and knowledge, you can navigate the world of cryptocurrency trading and make informed decisions that maximize your chances of success.