Cryptocurrency is a digital currency that uses cryptography to secure and verify transactions as well as to control the creation of new units. Crypto has become a popular asset class in recent years, with investors looking to profit from the volatility and potential returns of cryptocurrencies. However, trading crypto can be daunting for beginners. In this blog, we will discuss some trading strategies for crypto beginners to help them navigate the crypto market.

Fundamental Analysis:

Fundamental analysis involves analyzing the underlying factors that affect the value of a cryptocurrency. This includes analyzing the project’s team, technology, partnerships, and market trends. Fundamental analysis can help investors identify undervalued or overvalued cryptocurrencies.

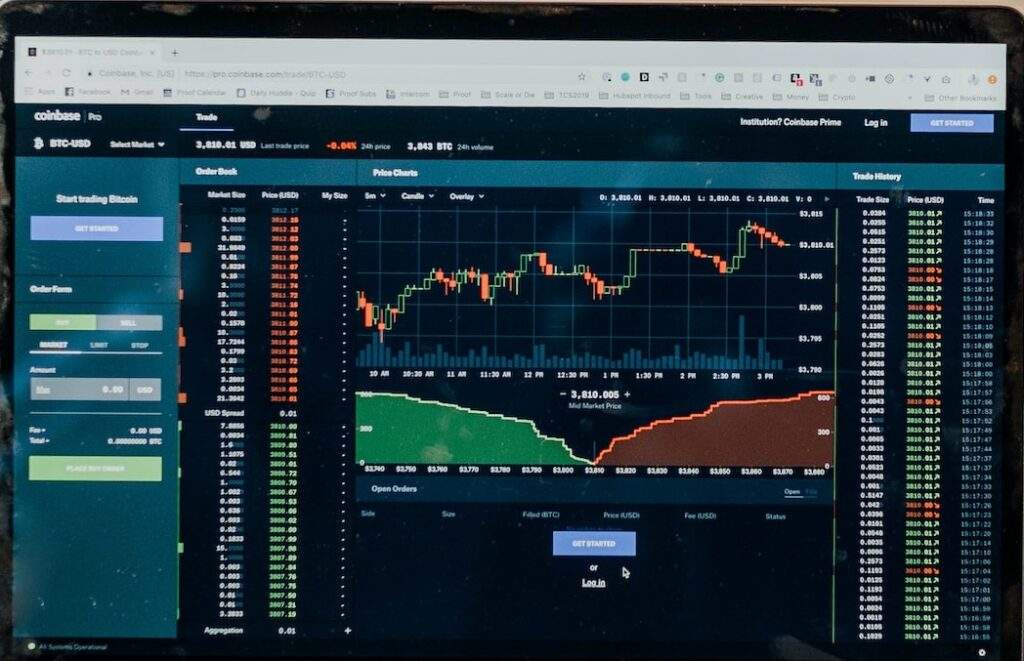

Technical Analysis:

Technical analysis involves analyzing past market data to identify trends and patterns. Technical analysts use charts, graphs, and other technical tools to identify potential entry and exit points. Technical analysis can help investors make informed decisions based on past market trends.

Buy and Hold:

The buy-and-hold strategy is a long-term investment strategy where an investor buys a cryptocurrency and holds it for an extended period. This strategy requires patience and a strong belief in the potential of the cryptocurrency. The buy-and-hold strategy is suitable for investors who are willing to hold on to their investment for a long time.

Dollar-Cost Averaging:

Dollar-cost averaging is an investment strategy that involves investing a fixed amount of money at regular intervals, regardless of the market price. This strategy allows investors to average out the cost of their investment over time. Dollar-cost averaging can help investors reduce the impact of market volatility on their investment.

Swing Trading:

Swing trading is a short-term trading strategy that involves buying and selling cryptocurrencies over a period of days or weeks. Swing traders aim to profit from the short-term price fluctuations in the market. Swing trading requires a good understanding of technical analysis and market trends.

Day Trading:

Day trading is a short-term trading strategy that involves buying and selling cryptocurrencies within a single day. Day traders aim to profit from the intraday price movements in the market. Day trading requires a lot of time, effort, and experience to be successful.

Scalping:

Scalping is a short-term trading strategy that involves making small profits from the market by buying and selling cryptocurrencies within seconds or minutes. Scalpers aim to profit from the small price movements in the market. Scalping requires a lot of experience, quick decision-making, and a good understanding of the market.

HODLing:

HODLing is a term used to describe the act of holding onto a cryptocurrency for a long time, regardless of its price fluctuations. HODLing requires a strong belief in the potential of the cryptocurrency and a willingness to wait for its value to increase over time.

Conclusion:

Crypto trading can be lucrative for investors who are willing to take the time to learn about the market and develop a trading strategy. The key to successful crypto trading is to have a solid understanding of the market, a clear investment goal, and a disciplined approach to trading. By following the trading strategies discussed in this blog, crypto beginners can increase their chances of success in the crypto market.