Cryptocurrency has become a buzzword in recent years, with many people investing in it and many others questioning its value. Cryptocurrencies such as Bitcoin, Ethereum, and Litecoin have gained a lot of popularity and attention in the global financial system. While some people view cryptocurrency as a bubble that will eventually burst, others see it as a revolutionary technology that can transform the way we do business and impact the global economy. In this blog, we will explore the potential impacts of cryptocurrency on the global economy.

What is Cryptocurrency?

Cryptocurrency is a digital or virtual currency that uses cryptography for security. Cryptography is the technique of converting information into an unreadable format to prevent unauthorized access. Cryptocurrencies operate on a decentralized system, meaning that they are not controlled by any government or financial institution. Instead, they rely on a peer-to-peer network to verify transactions and maintain the integrity of the system.

How Cryptocurrency Works:

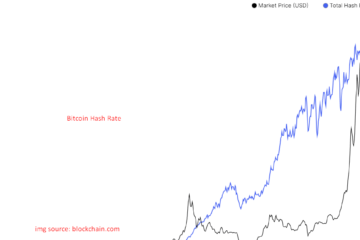

Cryptocurrency works through a blockchain, which is a decentralized ledger that records all transactions on the network. Each block on the blockchain contains a record of several transactions, and once a block is added to the blockchain, it cannot be altered. Transactions are verified by network participants, who are rewarded with cryptocurrency for their efforts. This verification process is known as mining, and it requires a significant amount of computational power.

Impact of Cryptocurrency on Global Economy:

-

Reduced Transaction Fees:

One of the most significant impacts of cryptocurrency on the global economy is the potential to reduce transaction fees. Traditional financial institutions charge fees for transactions, which can be significant, especially for international transactions. Cryptocurrencies eliminate the need for intermediaries, such as banks, and can reduce transaction fees significantly.

-

Increased Financial Inclusion:

Another potential impact of cryptocurrency on the global economy is increased financial inclusion. Cryptocurrencies provide a low-cost and accessible means of transacting, which could potentially benefit people who are unbanked or underbanked. This could have a significant impact on the global economy by improving access to financial services for millions of people.

-

Decentralized System:

Cryptocurrencies operate on a decentralized system, meaning that they are not controlled by any government or financial institution. This could potentially provide a more stable and secure financial system. With no central point of control, cryptocurrencies are not subject to the same vulnerabilities as traditional financial systems. This could potentially prevent financial crises and provide a more stable financial environment.

-

Increased Efficiency:

Cryptocurrencies could potentially increase efficiency in the global economy. The use of blockchain technology could enable faster and more secure transactions, reducing the time and costs associated with traditional financial transactions. This could lead to increased productivity and economic growth.

-

Reduced Fraud:

Cryptocurrencies could potentially reduce fraud in the global economy. Traditional financial systems are vulnerable to fraud and cyberattacks, which can result in significant financial losses. Cryptocurrencies operate on a decentralized system, making them less vulnerable to fraud and cyberattacks.

-

Increased Investment:

Finally, cryptocurrencies could potentially increase investment in the global economy. Cryptocurrencies provide an alternative investment option, which could attract new investors and potentially increase investment in the global economy. This could lead to increased economic growth and job creation.

Conclusion:

Cryptocurrencies have the potential to impact the global economy in a significant way. They could potentially reduce transaction fees, increase financial inclusion, provide a more stable financial system, increase efficiency, reduce fraud, and increase investment. However, there are also concerns regarding the volatility and regulation of cryptocurrencies. While the future of cryptocurrencies remains uncertain, they are undoubtedly a technology worth watching in the coming years.