Introduction

Crypto trading is the buying and selling of cryptocurrencies with the goal of making a profit. Cryptocurrencies are digital assets that use encryption techniques to secure and verify transactions on a decentralized network. In this blog, we will explore what crypto trading is, how it works, and its potential risks and rewards.

What is Crypto Trading?

Crypto trading is similar to traditional trading in that it involves buying and selling assets with the goal of making a profit. However, the assets being traded in this case are cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. These digital currencies can be traded on cryptocurrency exchanges or over-the-counter (OTC) markets.

Crypto trading can be divided into two categories: short-term trading and long-term investing. Short-term trading involves buying and selling cryptocurrencies with the goal of making a profit in a short period of time, usually within a day or even minutes. Long-term investing, on the other hand, involves holding onto cryptocurrencies for an extended period of time, usually several years, with the expectation that their value will increase.

How Does Crypto Trading Work?

Crypto trading works by buying low and selling high. This means buying cryptocurrencies when their value is low and selling them when their value increases. Traders use a variety of technical and fundamental analysis tools to predict the future price movements of cryptocurrencies.

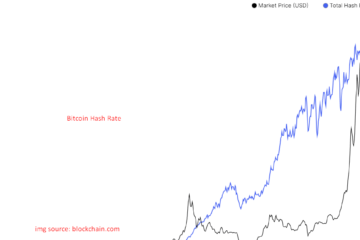

Technical analysis involves studying historical price charts and using technical indicators to identify trends and patterns in the market. Fundamental analysis, on the other hand, involves studying the underlying technology and market trends that affect the value of cryptocurrencies.

Once a trader has identified a potential trade, they can place an order on a cryptocurrency exchange or OTC market. The order can be a market order, which means buying or selling at the current market price, or a limit order, which means buying or selling at a specific price.

Risks and Rewards of Crypto Trading

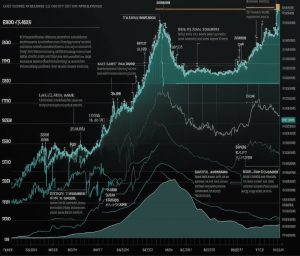

Like any form of trading, crypto trading comes with its own set of risks and rewards. One of the biggest risks of crypto trading is the volatility of cryptocurrencies. Cryptocurrencies are known for their wild price swings, which can lead to significant losses if not managed properly.

Another risk of crypto trading is the potential for fraud and hacking. Cryptocurrency exchanges and wallets are vulnerable to cyber attacks, and if a trader’s account is compromised, they can lose all of their digital assets.

On the other hand, the potential rewards of crypto trading can be significant. Cryptocurrencies have experienced significant growth in recent years, with some coins increasing in value by thousands of percent. Successful traders can make significant profits by buying and selling cryptocurrencies at the right time.

Conclusion

Crypto trading is a popular way to invest in cryptocurrencies and potentially make a profit. Traders use a variety of technical and fundamental analysis tools to predict the future price movements of cryptocurrencies and place orders on cryptocurrency exchanges or OTC markets. However, crypto trading comes with its own set of risks, including volatility and the potential for fraud and hacking. As with any form of trading, it is important to manage risk and only invest what you can afford to lose.